Infrastructure to offset housing & push tender prices higher

Infrastructure to offset housing & push tender prices higher

Surging infrastructure demand will keep construction costs high across eastern and southern Australia this year even as the residential construction boom comes off, WT Partnership’s latest report shows.

Infrastructure tender price growth of up to 7 per cent next year – driven by projects such as ongoing road and rail work and the Badgerys Creek Airport in NSW and Victoria’s Melbourne Metro Rail tunnel – will be boosted by defence contracts such as Future Frigate project in Adelaide and outstrip likely price growth of 3.5 per cent to 4 per cent in the non-infrastructure sector, the quantity surveying firm’s Australian Construction Market Conditions report says.

“The national picture is one of an industry remaining buoyant across the eastern states despite some slowing in residential construction,” the report says.

“Trades and resources remain tight, even scarce, as the infrastructure boom continues to strengthen along the east coast and across into SA where significant defence projects are about to start. Tasmania is also pressing the button on significant investments.”

The construction economy is weathering the early signs of weaker high-rise residential work with a pick up in infrastructure. Commercial construction is also picking up, driven by record-low office vacancy rates and as warehouse construction booms to meet the growing ecommerce demand and shopping centres retool themselves to provide experiences, rather than just products.

“The infrastructure sector is seen to be pushing up costs of labour, plant and equipment and base materials,” the report says.

“These pressures will continue to create an industry-wide challenge in the near term. Although cost increases in the building sectors have been tempered in competitive tender markets as main contractors and subcontractors adjust to declining high-rise residential projects, we will see near-term escalation increasing in all states and territories.”

‘Patchy around the country’

Reporting earnings last week, Brickworks chief executive Lindsay Partridge said demand for building materials was “patchy” across the country.

“It is patchy around the country,” Mr Partridge told The Australian Financial Review.

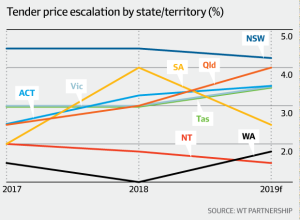

NSW will top the national price-growth chart this year with a likely 4.5 per cent overall pace of growth. SA, where construction is in “catch-up mode”, will be second with 4 per cent.

Queensland and Victoria will chalk up 3 per cent price growth, but the pool of project infrastructure work in both states is likely to push them higher in the medium term.

Tender price escalation in south-east Queensland will rise as high as 5 per cent by late 2020. Continued population growth is driving activity, along with large projects such as Dexus’ $1.4 billion Eagle Street Pier redevelopment and the Queen’s Wharf Casino precinct.

Tasmania will likely rise from 3 per cent over the 12 months to 3.5 per cent over the next three years, driven by hospitality and education work.

Ongoing housing construction, education and light rail will keep ACT construction prices growing, at between 3.25 per cent and 3.5 per cent in 2019 and 2020.

WA remains subdued, and although capacity remains in the construction economy, tender price growth will pick up from 1 per cent this year to 1.8 per cent next year.

Price growth in NT will cool, from 2 per cent in 2017 to 1.8 per cent this year and 1.5 per cent next year, the report predicts.